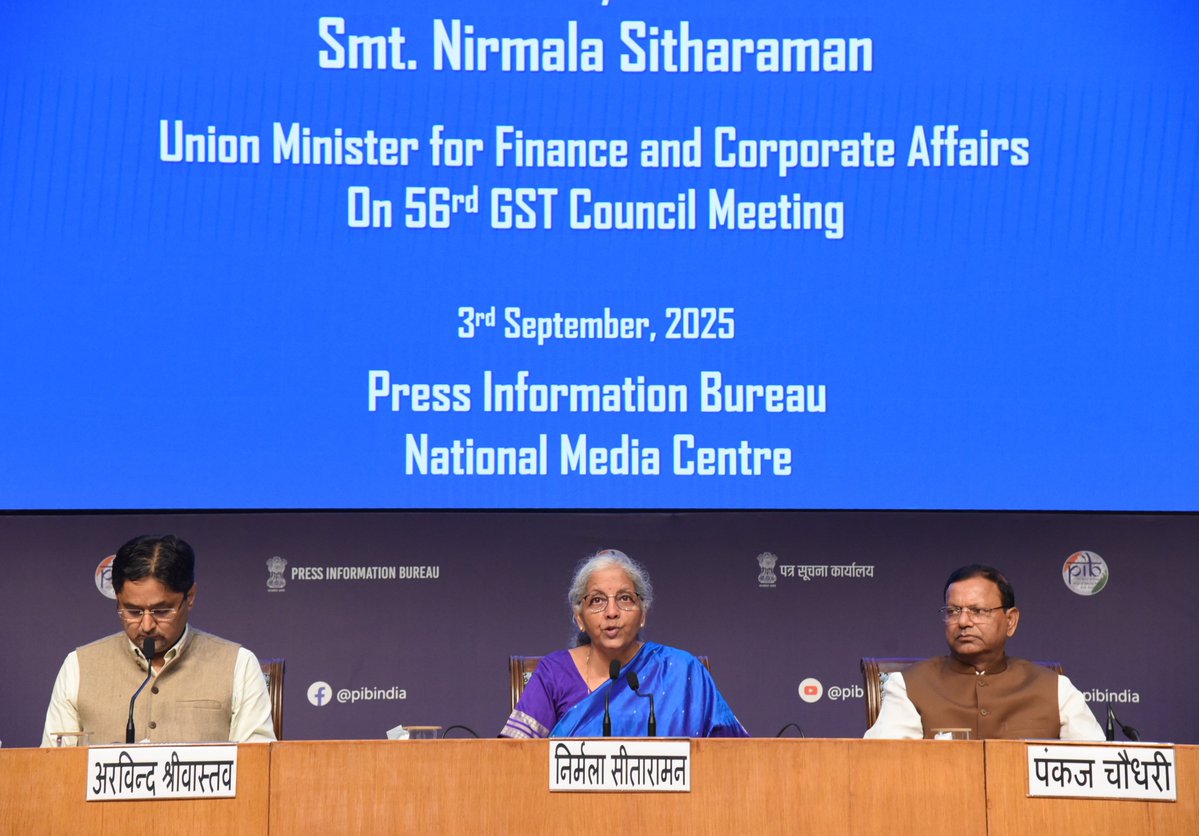

The Central Board of Indirect Taxes and Customs (CBIC) has announced significant alterations to the Goods and Services Tax (GST) rates in Notification No. 09/2025-Central Tax (Rate), issued on September 17, 2025. These adjustments, effective from September 22, 2025, are designed to provide financial relief primarily to the common man and the aspirational middle class, a topic discussed extensively at the 56th GST Council meeting held on September 3, 2025.

Overview of the GST Changes on Goods

The revised GST rates encompass a variety of goods categorized into different schedules. The key highlights are as follows:

- 2.5% GST on essential goods under Schedule I, including items like milk products, edible oils, and medicines.

- 9% GST on processed foods and household items listed under Schedule II.

- 20% GST on luxury and sin goods found in Schedule III.

- 1.5% GST under Schedule IV for select essentials.

- 0.125% GST for specified precious goods in Schedule V.

- 0.75% GST for special category items in Schedule VI.

- 14% GST on certain higher-taxed items under Schedule VII.

While the details regarding changes in service-related GST rates and exemptions from the GST Council meeting remain pending, the adjustments in goods provide clarity to consumers and businesses.

Breakdown of Significant Changes

The revised GST rates include substantial reductions across categories, aimed at easing the financial burden on consumers, as indicated in the categories below.

Reduction from 12% to 5%

A variety of food items and health products have seen a GST reduction to 5%. Key items include:

- Food Items (47 total): This includes condensed milk, butter, cheese, dried fruits, diabetic foods, and beverages.

- Health Products: All drugs and medicines, including surgical instruments and diagnostic kits.

- Agricultural Machinery: Machinery for farming, such as tractors, pumps, and composting machines.

- Renewable Energy products such as solar cookers and bio-gas plants.

- Textile Products: Various textile items including carpets, threads, and sewing materials.

- Common Items: Such as feeding bottles, hand bags, and sewing machines.

Reduction from 18% to 5%

This category also sees a reduction primarily affecting food items and health products. Notable inclusions are:

- Food Items (23 total): Including malt, sugar confectionery, and ice cream.

- Health Products: Including medical thermometers and certain fertilizers.

- Agricultural Equipment: Various tractor parts and accessories.

Reduction from 28% to 18%

Items here include machinery and construction materials that experience a significant tax drop, including:

- Machinery: Electric accumulators and pumps.

- Construction Materials: Types of cement, including Portland cement.

- Consumer Electronics: Air-conditioning units, washing machines, and televisions.

Increases in GST Rates

Conversely, some items will see an increase in GST rates:

- Increase from 18% to 40%: This increase applies to non-alcoholic beverages.

- Increase from 28% to 40%: Covers pan masala, carbonated drinks, and various tobacco products.

- Increase from 5% to 18%: Coal, lignite, and peat will now attract a higher tax.

- Increase from 12% to 18%: Various odoriferous preparations and specific paper products.

No Change but Value Adjustment

Textiles and clothing accessories priced at or below ₹2,500 will continue to be taxable at 5% GST. However, items valued above ₹2,500 will be taxed at 18%.

The complete details of the notification can be accessed through the official document provided here.

These revisions in GST rates reflect a concerted effort by the government to alleviate the financial challenges faced by everyday citizens, aligning with the discussions and objectives set forth during the GST Council meeting earlier this month.